Digital 2019 Spotlight: Ecommerce in Malaysia

More than 26 million Malaysians use the internet today, and data from GlobalWebIndex shows that 80 percent of users between the ages of 16 and 64 are already shopping online.

Malaysians already spend considerably more on online purchases than many of their Southeast-Asian neighbours, but average ecommerce revenue per user (ARPU) in the country is still barely a quarter of the global average.

However, Malaysians’ ecommerce spending grew by 24 percent last year, and with the country’s government making the growth of the online economy a national priority, it’s likely that Malaysia will continue to enjoy strong growth in online shopping over the coming years.

You can explore the country’s broader digital landscape in our complete Digital 2019 Malaysia report below, but read on for a closer look at all the latest ecommerce data and insights.

Note: this article contains a number of updates to statistics featured in the report above. Also note that some of our data providers have recently changed their reporting methodologies, so some of the figures we reference in this article will not be directly comparable to figures published in the report embedded above, especially for internet and social media users.

Ecommerce in Malaysia

Data from Statista’s Digital Market Outlook survey shows that Malaysians spent more than US$6 billion online in 2018, with purchases of consumer goods already outweighing spend on travel.

Malaysia’s online consumer goods category was worth a total of US$3.1 billion in 2018, accounting for 51 percent of total ecommerce spend.

Purchases of electronics made the greatest category contribution, at 27 percent of overall consumer goods spending. Fashion and beauty products weren’t far behind though, with annual spending of US$771 million accounting for a quarter of total online consumer goods market.

However, the average Malaysian ecommerce shopper spent just USD $159 on online consumer goods purchases in 2018 – significantly lower than the global average of USD $634.

Travel purchases are still an important component of Malaysia’s online economy though, with the country’s internet users spending more than US$2.7 billion on online travel purchases in 2018.

Consistent with other countries across Southeast Asia, however, the market for digital content remains small in Malaysia.

Malaysians spent US$236 million last year on purchases of video games, digital music, video-on-demand services (e.g. Netflix), and digital news and magazines.

Digital music accounted for just $30 million of that total, although this figure means that Malaysians are the second biggest per-capita spenders on digital music in the region, behind Singapore.

It’s also interesting to note that Scribd.com also makes it into SimilarWeb’s ranking of Malaysia’s top ten transactional websites by total monthly visits, suggesting that the country’s internet users are already quite comfortable consuming digital content.

Overall, Malaysia’s ecommerce sector is enjoying strong growth, with Statista’s data showing that combined spend across all sectors grew by 24 percent last year.

The travel sector grew by a more modest 18 percent, but that was still enough to deliver an additional US$400 million in spending compared to 2017.

The online consumer goods market grew much more rapidly though, despite the sector already accounting for more than half of the country’s ecommerce market.

Online sales of products like clothes, electronics, toys, furniture, and groceries grew by 30 percent in 2018, up by more than US$730 million versus 2017 spending.

Within the consumer goods category, all sectors grew by at least 25 percent year-on-year, with three sectors growing by more than 30 percent in just 12 months.

Mirroring a pattern we’ve seen across all the other countries in Southeast Asia, the country’s online grocery sector is growing most rapidly, with annual purchase value increasing by an impressive 39 percent in 2018.

That puts Malaysia in second place in Statista’s ranking of the world’s fastest-growing grocery markets in 2018, with only Singapore seeing a greater year-on-year increase.

This isn’t just good news for the country’s online grocers, either. As we explained in a previous article in this series, food and personal care items account for some of our most frequent purchases, and as an increasing share of this purchase activity moves online, shoppers become increasingly familiar with online shopping.

Provided these regular grocery experiences remain positive, this increased familiarity should drive greater confidence in online shopping as a whole, which in turn may lead to increased ecommerce activity across all categories.

So, given the potential significance of the grocery category for the country’s ecommerce industry as a whole, it’s worth exploring Malaysia’s online grocery sector in more detail.

Online grocery in Malaysia

Malaysians spent US$483 million on online grocery purchases in 2018, up by US$135 million versus 2017 spending.

This figure means that online grocery accounted for 2.3 percent of Malaysia’s US$21 billion total grocery market in 2018 (factoring both online and offline sales).

Based on data from eMarketer, that may mean that Malaysia is already ahead of the US when it comes to moving grocery spends online.

However, research firm IGD predicts that online shopping will still account for roughly the same share of Malaysia’s total grocery spend in 2022, suggesting there are still significant differences across estimates and forecasts for the value of Malaysia’s online grocery market.

Despite these discrepancies, the overall story seems consistent: Malaysia will continue to enjoy strong growth in online grocery spend over the coming years.

IGD Asia predicts that online sales value will increase at a compound annual growth rate (CAGR) of more than 60 percent between 2017 and 2022, compared to a CAGR of 4.1 percent for the grocery market as a whole between 2018 and 2023.

So who’s best placed to capture a disproportionate share of this increasing market?

Top ecommerce retailers in Malaysia

Malaysia’s online economy sees a good mix of local, regional, and global brands.

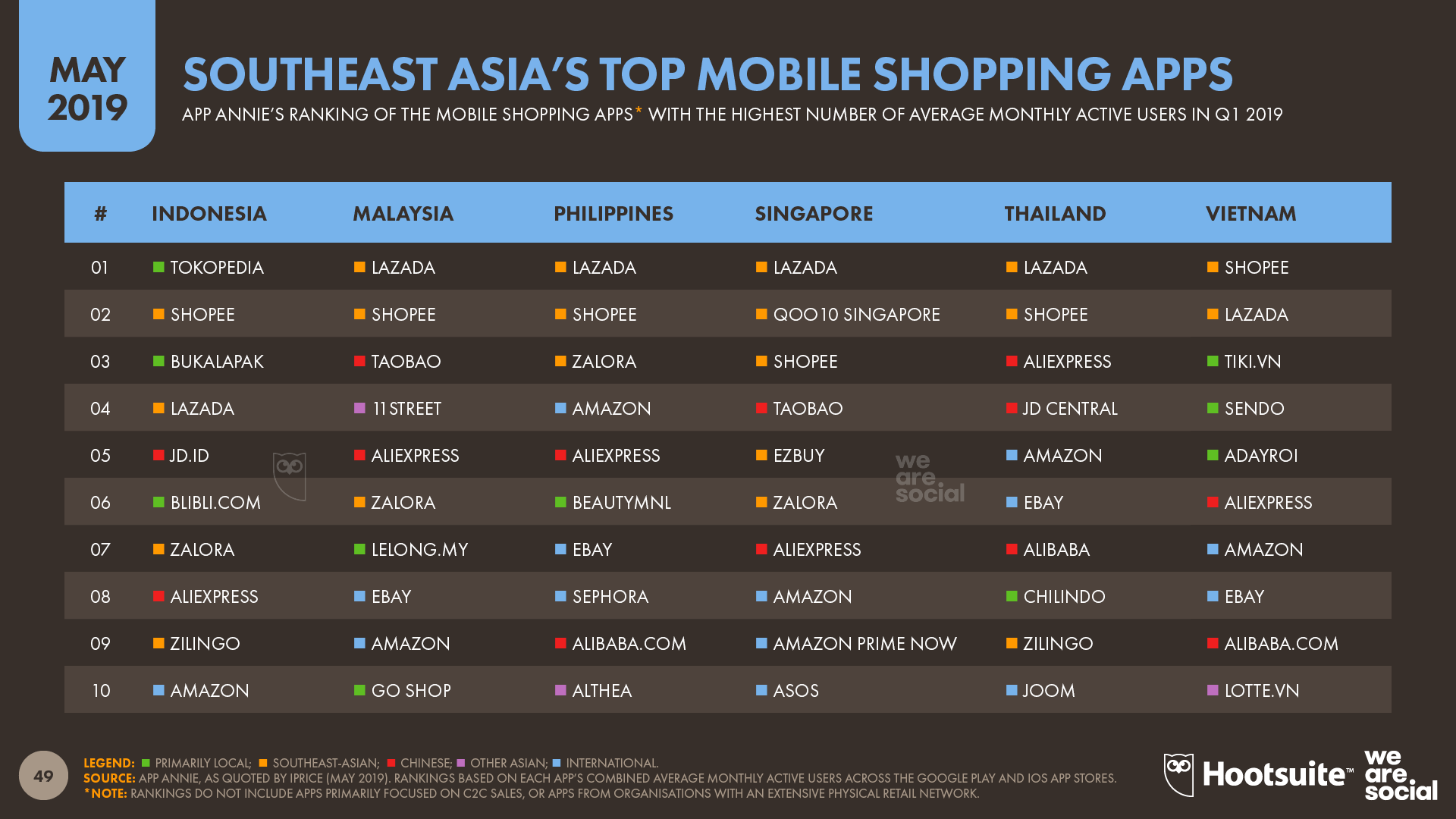

Consistent with a trend we’ve seen in various other countries across Southeast Asia, Shopee and Lazada dominate the overall ecommerce landscape in Malaysia.

SimilarWeb data suggests that Shopee’s Malaysian site comes out top in terms of total monthly traffic, attracting an average of more than 22 million visits per month.

Lazada isn’t far behind Shopee in SimilarWeb’s rankings though, with the company’s local Malaysian website attracting an average of 21 million monthly visits between May and July 2019.

The story reverses in App Annie’s ranking of Malaysia’s top mobile shopping apps though, with Lazada attracting more active users than Shopee across the first three months of 2019.

What’s more, given that Malaysia’s internet users are significantly more likely to buy via a mobile than a computer (62 percent vs. 37 percent), the mobile app rankings are perhaps more indicative.

It’s interesting to note that Taobao’s mobile app performs particularly well in Malaysia, suggesting that the country’s Mandarin speakers are avid online shoppers.

However, Korean products also appear to be popular in Malaysia, with 11Street’s mobile app placing fourth in App Annie’s ranking.

The Fashion & Beauty category is also a popular choice with Malaysia’s mobile shoppers, with top regional fashion platform Zalora also appearing in App Annie’s top ten.

However, Malaysia’s web shoppers exhibit some different preferences and behaviours.

Samsung.com comes in at number three in SimilarWeb’s website rankings, although it’s unclear what percentage of the site’s visitors actually go on to buy something (as opposed to merely looking for product information and company news).

Microsoft.com also appears in Malaysia’s top 10 ecommerce sites, reinforcing the finding that electronics account for the greatest share of online consumer goods spending in the country.

Local marketplace Mudah.my is also a Malaysian favourite, with SimilarWeb reporting that the site attracted an average of more than 10 million visits per month between May and July 2019.

Travel sites are also a popular online destination in Malaysia, with both AirAsia.com and Agoda.com appearing in SimilarWeb’s ranking of the country’s 10 most-visited websites.

International shopping platforms also do well, with Taobao and Amazon both ranking in SimilarWeb’s top 10.

A closer look at Malaysia’s online grocery players

As we saw above, Shopee and Lazada dominate Malaysia’s ecommerce landscape, but it’s unclear what share of their respective revenues are attributable specifically to grocery purchases.

Supermarket chain Tesco attracts the greatest number of monthly visits to its website compared to other dedicated grocery players in the country, but data from SimilarWeb suggests that the site’s traffic is still relatively low, with fewer than half a million visits per month.

Fellow bricks-and-mortar players Jaya Grocer and Mydin also enjoy moderate online success, with each brand’s website attracting more than 100,000 visits each month.

However, with Statista’s data showing that almost 20 million people in Malaysia already buy consumer goods online, these traffic numbers seem quite low, especially given the average frequency of grocery purchases.

It’s also interesting to note that a number of the country’s larger bricks-and-mortar chains still don’t yet offer dedicated online shopping in Malaysia, instead choosing to partner with HappyFresh to provide home delivery of items from their physical stores.

Indeed, the websites of Cold Storage and Giant – two of the country’s top supermarket chains – both direct prospective shoppers directly to HappyFresh’s website.

Interestingly, a number of specialist online grocers have entered the Malaysian market in recent months, offering items such as organic products.

Some of these sites have already gained good momentum too, with SimilarWeb data showing that one of these players – Signature Market – already attracts an average of more than 100,000 visits per month.

Ecommerce outlook: Malaysia

Analysts all seem to concur that Malaysia will enjoy particularly strong ecommerce growth over the coming years, with eMarketer predicting that the country will be in the top five fastest-growing ecommerce markets this year.

There are also fewer barriers to ecommerce growth in Malaysia compared to many other Southeast-Asian nations, and with Malaysia’s government already declaring that the ecommerce sector is a national priority, the future of ecommerce in the country looks compelling.

Looking for more data on Malaysia? Check out all of our previous country reports by clicking here.