Digital 2014: Americas Regional Overview

It's been a few months since our 2014 Europe report, but today we're delighted to announce the publication of the latest in our ongoing series of studies into the Social, Digital and Mobile landscapes from around the world.

This new report explores 30 countries across North, Central, and South America and The Caribbean, and contains more than 230 slides with all the key statistics, data and behavioural indicators you need to understand the digital landscapes across The Americas.

You can read the complete report in the SlideShare embed above, but read on for some of the essential highlights.

Global update

Let’s begin with a fresh look at the key global statistics:

It's worth noting that we've changed our data source for Internet users, so there has been a marked changed in the figures reported for this area since our Europe report.

There have also been some changes in the global social media platform rankings since that Europe report, with Tencent's WeChat passing Google+ to take the number 5 spot:

Brands belonging to China's Tencent now account for three of the top five social media platforms in the world, with Qzone, QQ, and WeChat all recording growth in monthly active user (MAU) numbers in the company's most recent quarterly results.

Facebook showed more modest relative growth since our last report, but still recorded 50 million new active users since February.

Google+'s reported active user numbers grew roughly 14% in the same period, up from 300 million, while LinkedIn posted 16% growth in MAUs.

However, the big growth story is WeChat, which posted 46% growth – almost 125 million new MAUs – since our last update. By comparison, WhatsApp grew just over 11% in the same period, adding 50 million new active users.

It's also worth noting that more than 200 million people around the world now use Facebook's standalone Messenger platform, but this doesn’t bring it into the top 10 rankings (yet).

The Americas

Added together, the populations of The Americas are approaching 1 billion, accounting for 13% of the world's total population.

The region claims a disproportionate share of the world's users across all digital areas though, with social media showing particular strength in the region:

Mobile social figures in the region are even stronger still, with one-quarter of all global mobile social media users calling The Americas home.

The internet in The Americas

There are more than 600 million users across The Americas - 63% of the region's population - with 60% of these users living in North America:

Internet penetration varies considerably across the region though, from 95% in Canada down to just 12% in Haiti:

Mobile internet usage is growing throughout The Americas too, although mobile's share of total web traffic varies considerably:

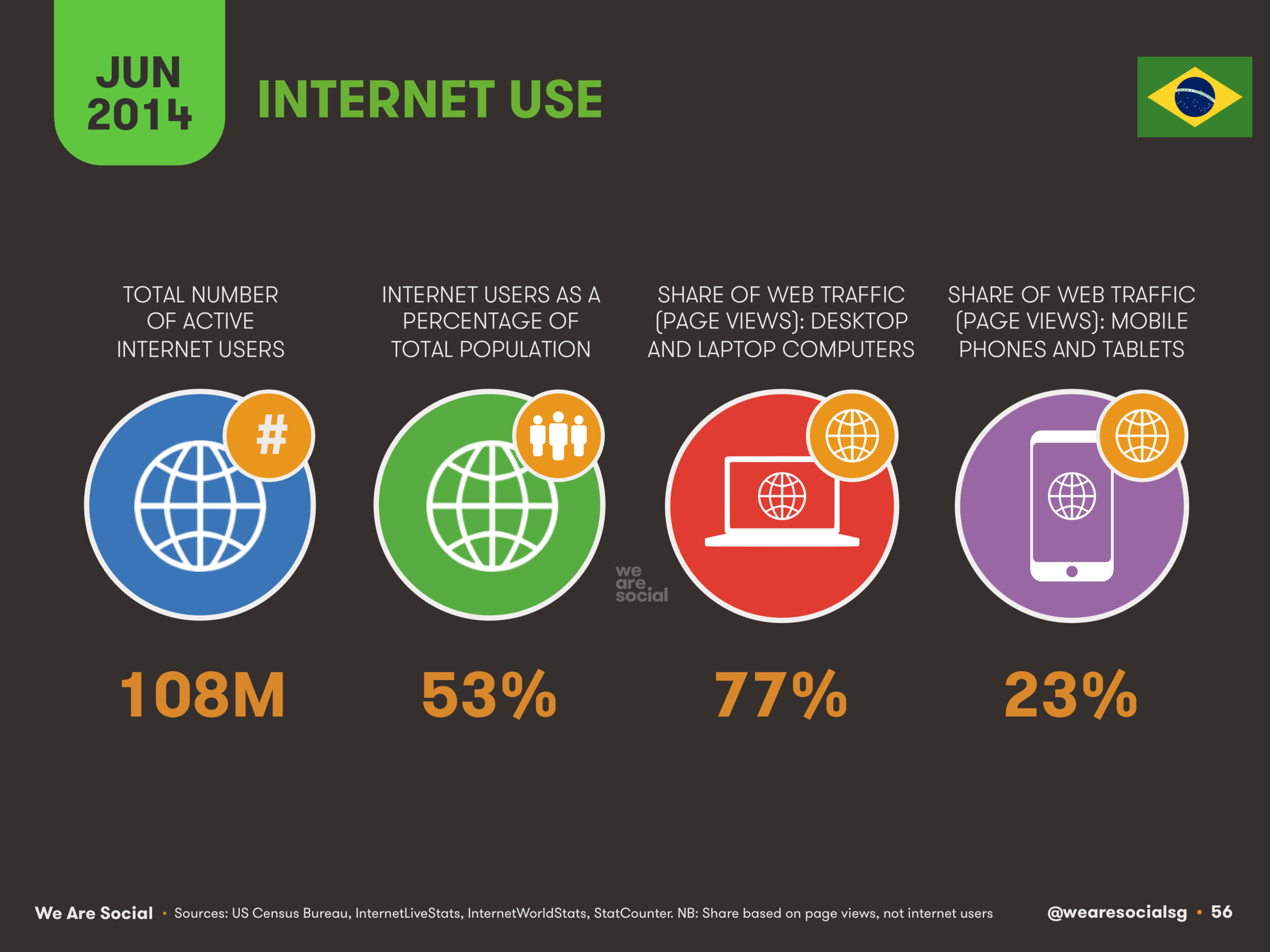

Note that the chart above is based on the share of total web traffic – i.e. page views – as opposed to the number of actual internet users.

Social media in The Americas

Facebook dominates social media across The Americas, with more than 460 million monthly active users.

As with internet use, though, social media penetration levels vary considerably by country, from 61% in Chile down to just 7% in Haiti:

Note that Facebook does not report user numbers for Cuba.

It’s worth highlighting that our figures for social media penetration in individual countries will often exceed those for internet penetration, especially in fast-evolving markets. There may be a number of reasons for this:

Social media stats are almost always more up to date than those for internet usage, largely because they are collected by commercial entities on an on-going basis and published at least quarterly to help with advertising sales. In Facebook’s case, the monthly active user figures are available in almost real-time.

Many reports on internet usage and penetration omit mobile internet usage, meaning many mobile-only users aren’t included in the internet user figures (partly because they’re more difficult to identify). However, in many emerging markets, mobile-only use can account for a significant proportion of internet users (even if slow speeds mean they account for a relatively low share of the overall web traffic). In contrast, people accessing social media through mobile devices will be counted in social media user figures, meaning that social media numbers are often a more accurate indication of actual internet use and penetration in these markets.

On the other hand, some people may have multiple social media accounts on the same platform, leading to a slight inflation of social media users, although we don’t anticipate this is the main cause for the difference between internet and social media usage numbers.

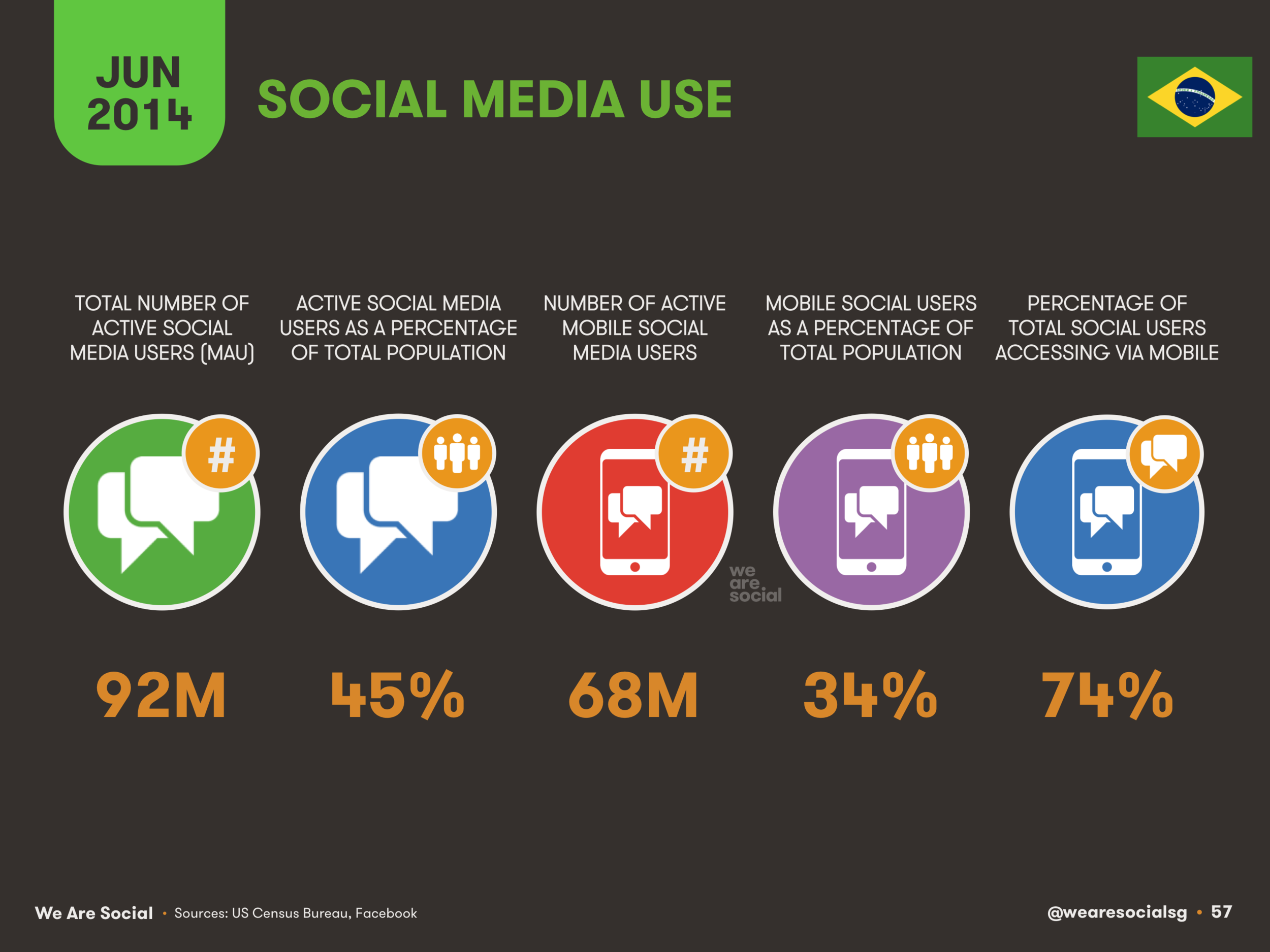

Mobile social media use is common amongst social networkers throughout The Americas, with more than 80% of social media users logging in via mobile devices:

Perhaps unsurprisingly, penetration levels for mobile social follow similar patterns to those of general social media use, although there are some variations between individual countries:

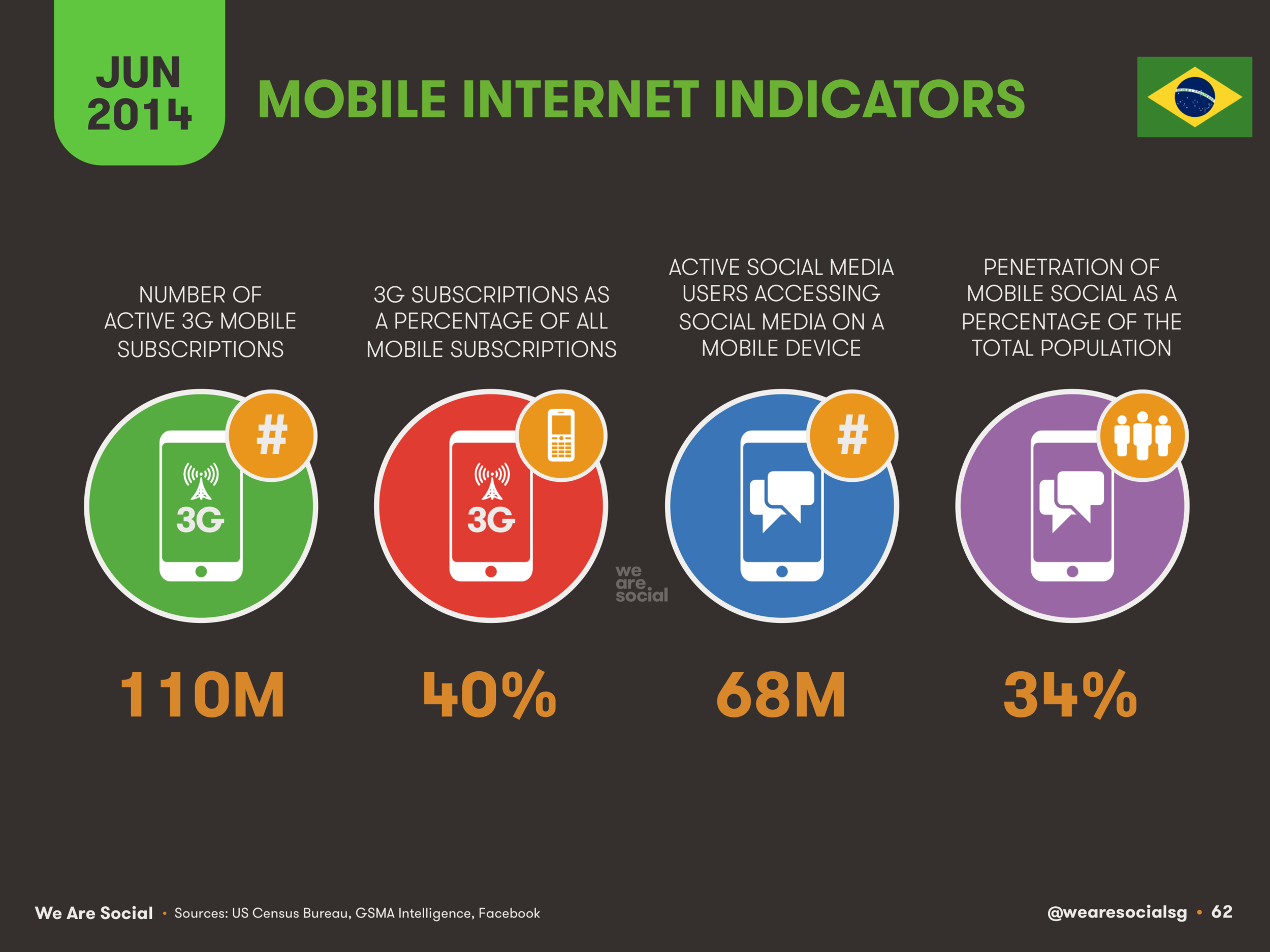

These numbers are particularly interesting when compared to penetration levels for 3G mobile access, which you'll find below.

Mobile in The Americas

There are just over 600 million unique mobile users in The Americas, with each user maintaining an average of 1.77 active subscriptions, resulting in more than 1 billion active mobile connections across the region:

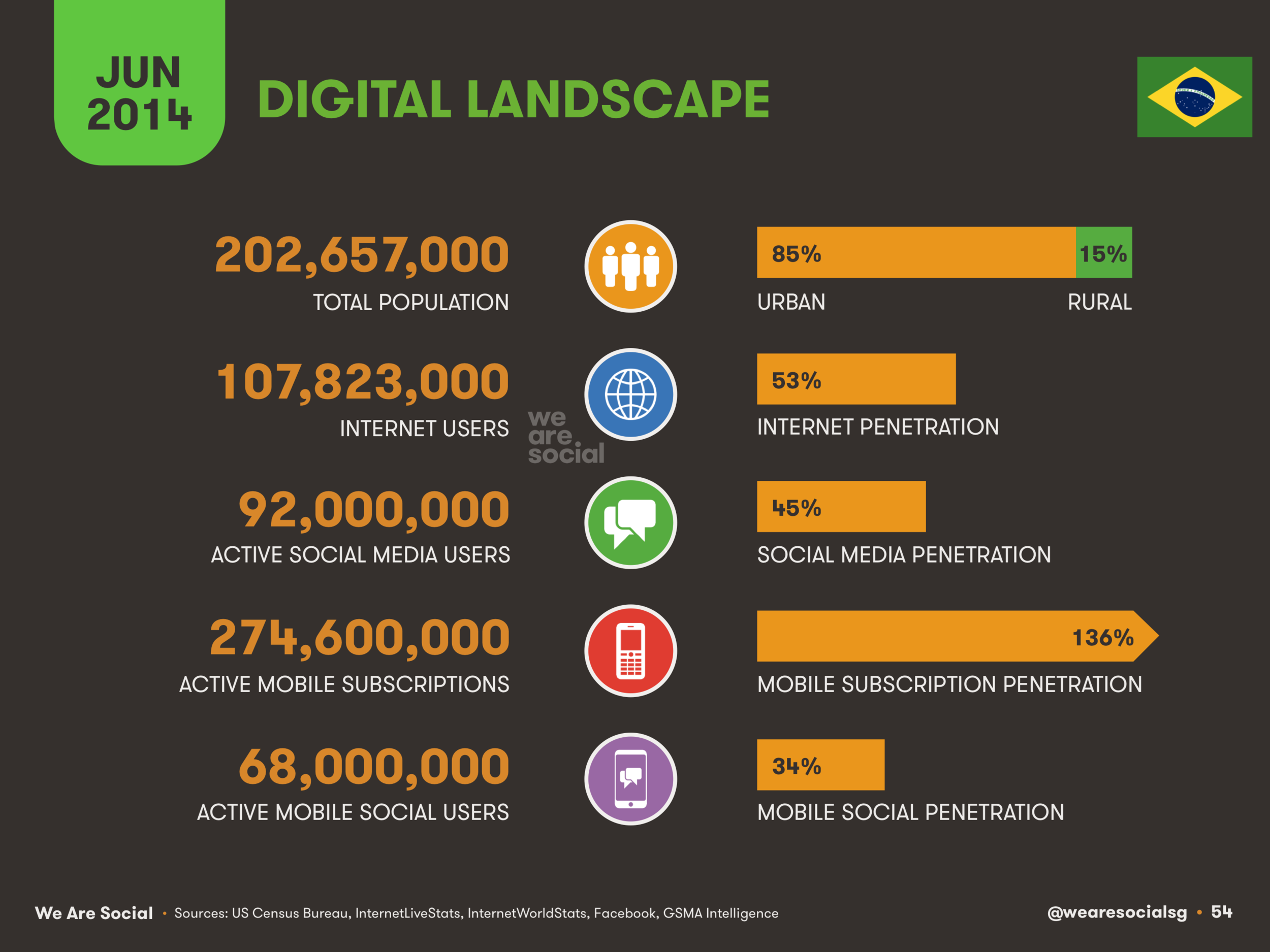

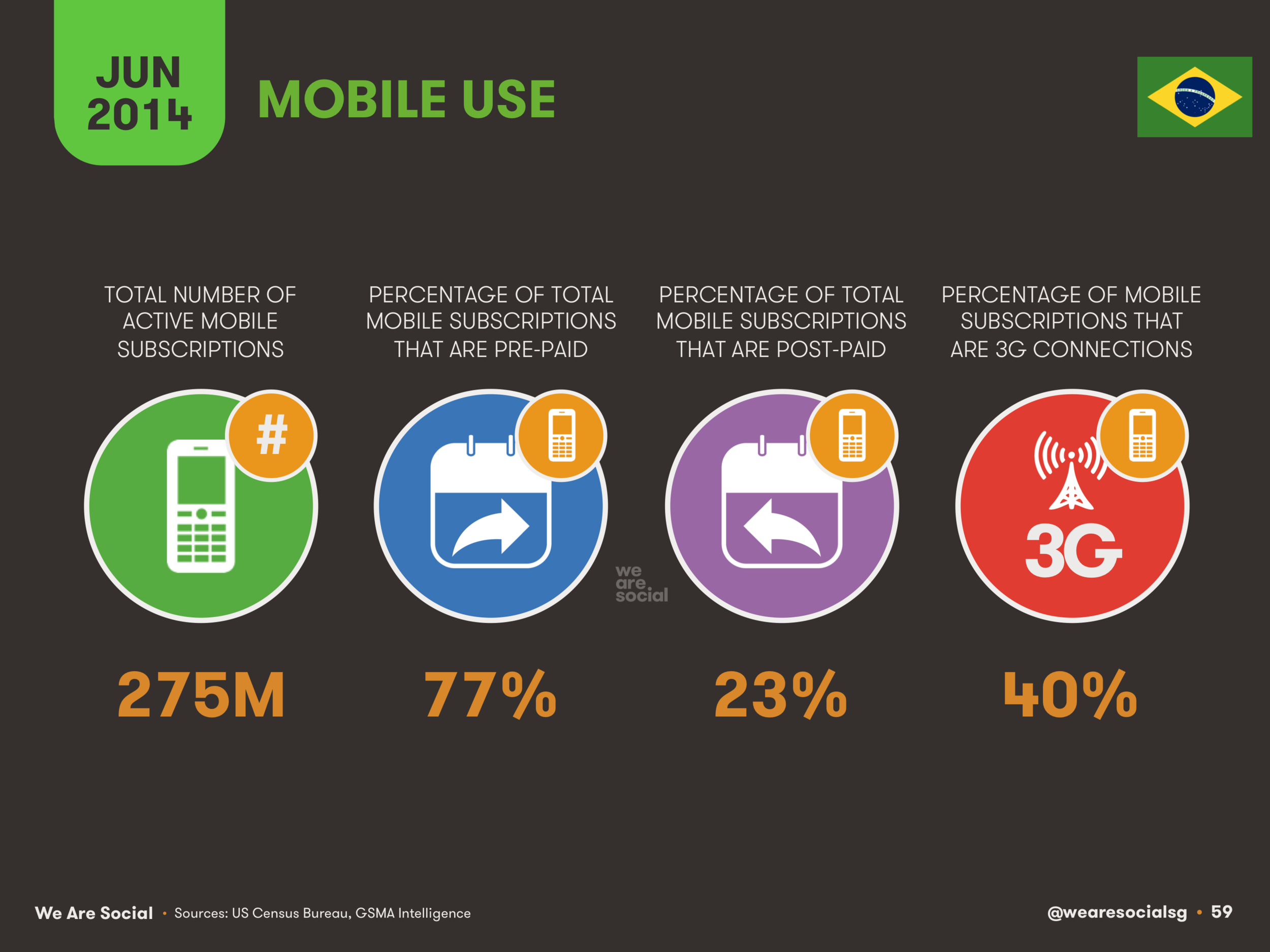

Behaviour again varies between individual countries though, with Chile, Argentina, and Brazil all home to subscription rates well in excess their populations:

Mobile subscriptions aren't all created equal though, and there are some significant differences between individual countries when it comes to pre- and post-paid contracts:

Similarly, access to faster 3G networks isn't evenly distributed across the region, ranging from a high of 55% in the United States to barely 0.0005% in Cuba:

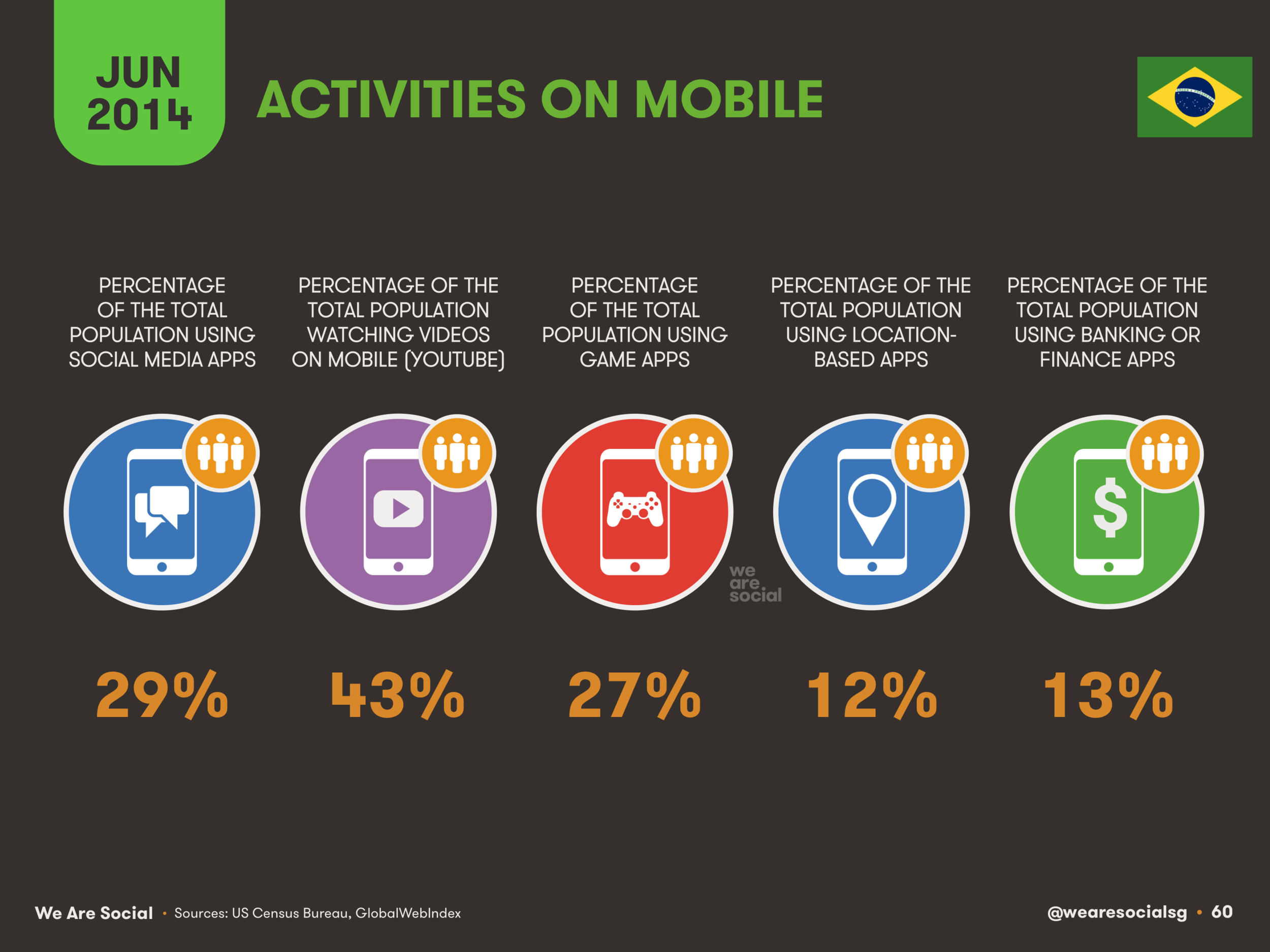

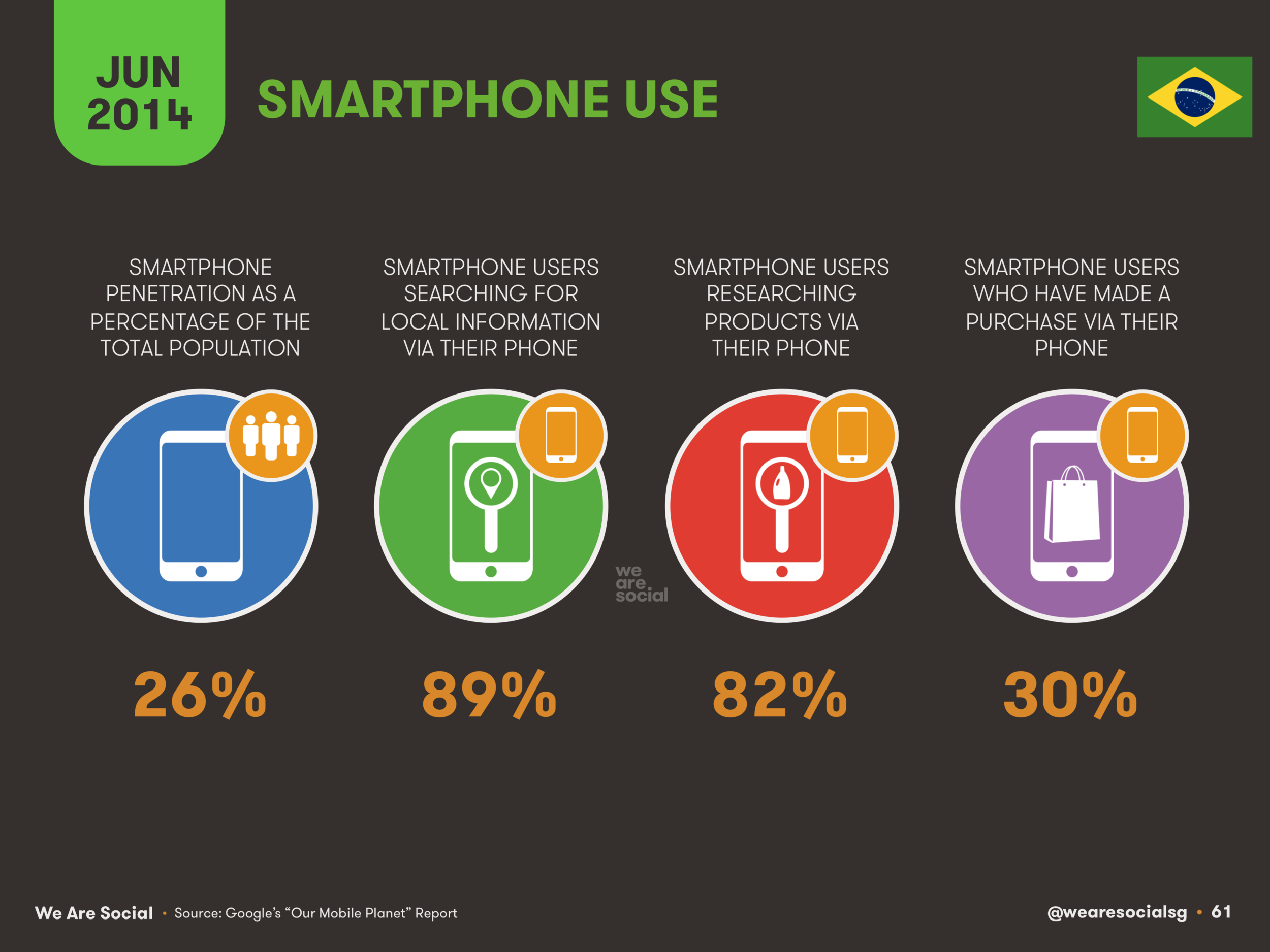

As a result, access to an affordable, rich mobile internet experience remains elusive for many people across Central and South America, and marketers will need to craft content and distribution plans accordingly.

Regional snapshots

In addition to the regional overview, the report also features regional breakdowns for North, Central, and South America, as well as The Caribbean:

Local country insights

In addition to these regional snapshots, our Americas report also contains detailed reports on 30 individual countries:

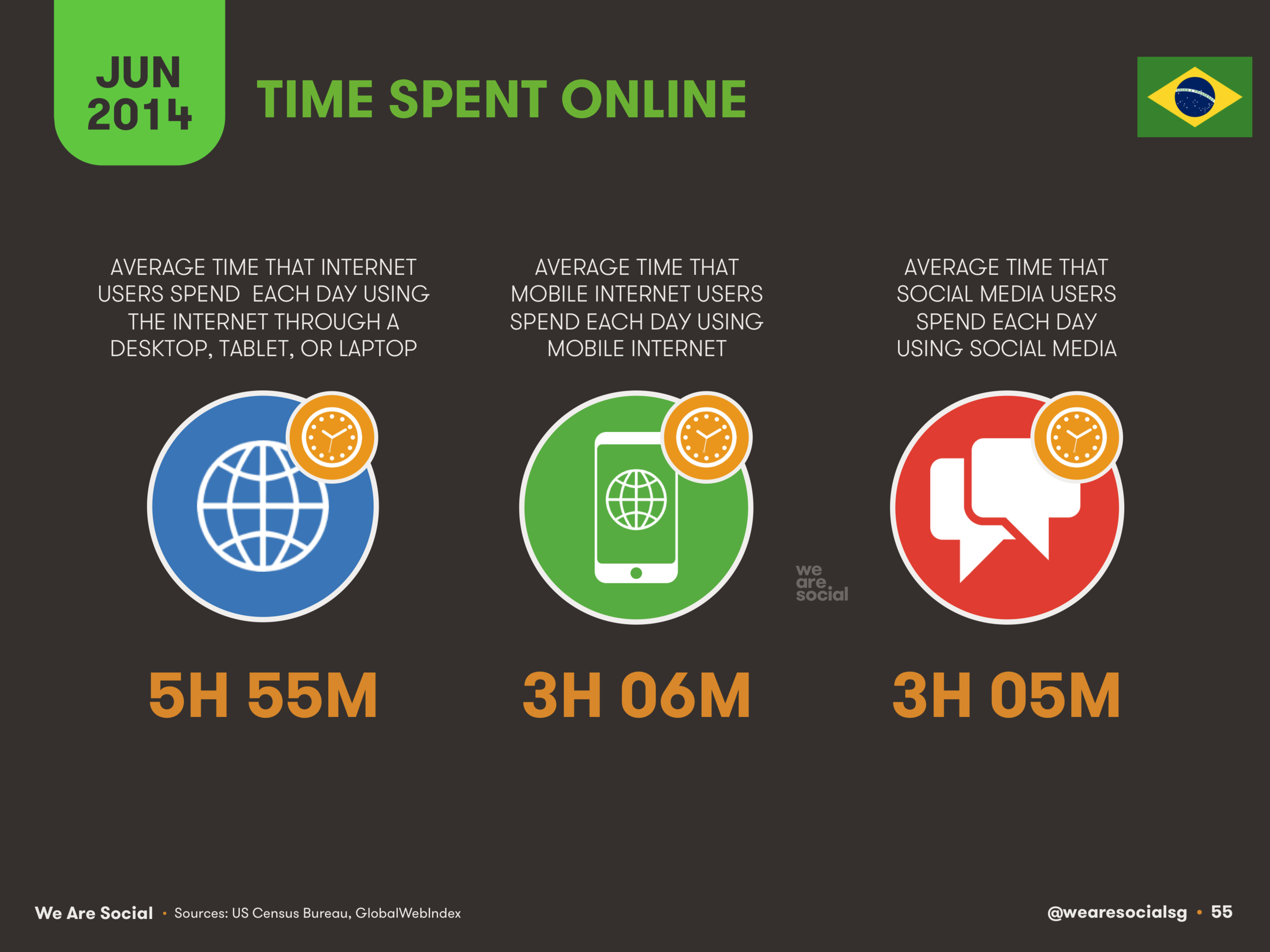

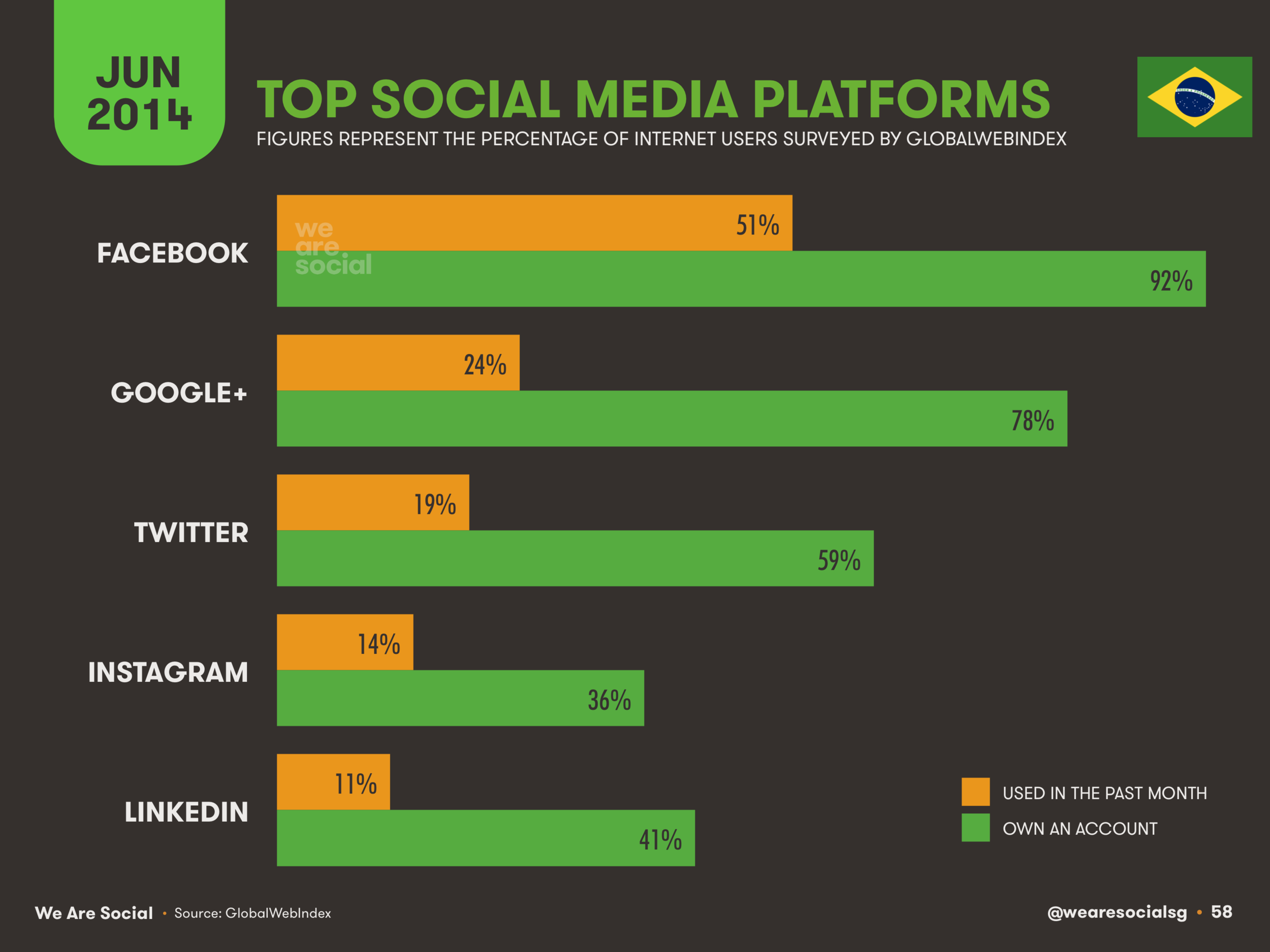

To whet your appetite, heres a slideshow with the local country slides for Brazil:

You can read the full Americas report in the SlideShare embed at the top of this article, or click here to see our complete collection of reports covering countries in The Americas. You can also click here to download a free PDF of the complete 2014 Americas report (you may need to sign in to SlideShare first).

We'd like to thank the lovely folks at GlobalWebIndex for allowing us to use their data again in this report.

This article first appeared on the We Are Social blog.