Digital 2015: Asia-Pacific Regional Overview

Continuing our ongoing series of studies into digital usage around the world, today we're delighted to bring you our latest report: Digital, Social & Mobile in APAC in 2015.

In much the same way as we saw in our recent Global Report, 2014 was an impressive year for all things digital in Asia-Pacific too, with all aspects of internet, social media and mobile use showing impressive growth.

To help marketers keep track of these impressive numbers – and understand what they mean for their brands – We Are Social has teamed up with the IAB in Singapore to bring you an in-depth study of digital in the world’s most populous region, including deep-dive analyses for 30 of the region's key markets.

SlideShare limits the total number of slides we can include in one presentation, so we’ve had to split this report across two separate embeds.

So what does the report reveal?

The headlines

Well over one-third of APAC’s population now uses the internet, and more than one-quarter have used social media in the past 30 days.

Mobile continues its dramatic rise too, with the number of cellular connections in the region growing by more than 11% since our 2014 APAC report.

Mobile social is the hottest digital trend in APAC at the moment though, with the number of people in the region accessing social media from mobile devices jumping an impressive 32% in the past year, to reach 900 million. Current trends suggest that mobile social users will exceed 1 billion by early Q4 2015.

Let’s start by taking a quick look at some fresh updates to the global picture, before diving into a more detailed analysis of each key area of the digital landscape in APAC.

Global update

Data published since our global report in January show that the number of global internet users grew by 28 million in the past two months alone, although it’s important to stress that this is more likely due to more accurate and timely reporting than it is to do with growth in actual users.

People are doing more on the internet too, with video in particular seeing an impressive share of online activity:

The reported number of active social media accounts on the largest social network in each country shot up by more than 47 million since January too, with all of that growth attributable to Facebook (Tencent will report the latest numbers for China’s QZone, QQ and WeChat later this month).

These increases in Facebook use may be driven by the return of lapsed users as much as by new account sign-ups, but Facebook will still be pleased with growth of close to 10 additional active accounts every second since our global report.

We’ve seen some impressive jumps in the number of active users reported for some other top social platforms too, with WhatsApp (+100 million), Baidu Tieba (+100 million) and Viber (+27 million) all reporting significantly higher global numbers since January.

However, based on a number of reports on Google+ in recent weeks – including Google’s own announcement that it plans to make some significant changes to the service – we’ve revised the number of active users down by 43 million:

People are doing more with their social media time too, with the number of video views on Facebook and the number of messages shared on WhatsApp both showing some impressive growth in recent months:

GSMA Intelligence also reports impressive growth in the number of unique mobile phone users, with the global tally up by 30 million in the past two months.

Current global trends suggest that roughly half a million people gain access to a mobile handset every day.

The stand-out growth comes from mobile social media usage though, with growth of 68 million active user accounts in the past two months – that’s more than 1.1 million active accounts every day, or 13 every seconds.

As the chart below shows, more people around the world now access Facebook through mobile devices than do through personal computers, and all the data suggest the gap is getting wider every day:

The internet in APAC

Asia’s population reached an important milestone in 2014, passing 4 billion people for the first time. However, the region’s digital population is growing much faster, with internet users growing almost four times faster than the general population.

At 91%, New Zealand leads the region in terms of overall internet penetration. Australia (89%), South Korea (88%) and Japan (86%) are next, with Singapore (81%) rounding out the top 5.

However, internet penetration remains below 10% in Timor-Leste (1%), Myanmar (5%) and Papua New Guinea (6%), while data suggests that fewer than 10,000 people in North Korea – or 0.003% of the country’s population – has access to the internet as we know it:

APAC countries recorded 180 million new internet users since last year’s report (January 2014), meaning we’re seeing more than 1.25 million new users each month – that’s more than 5 new users every second.

The most significant changes in internet usage came in Cambodia and Myanmar, where the reported number of users grew by 414% and 346% respectively, while Papua New Guinea also saw impressive growth of 193%. As we mentioned above though, this growth is likely due to more accurate reporting, rather than because all those people suddenly started using the internet in the past year:

The accuracy of internet user data in APAC continues to be a cause for concern though, with the most recent ‘official’ data for many developing countries often 2 to 3 years old.

Alarmingly, the number of internet users reported by official sources for Indonesia hasn’t changed since last year’s report, meaning that actual penetration in the country may be considerably higher.

If we use the growth in social media users as a reliable proxy*, the number of internet users in Indonesia likely rose by around 20% in the past year, suggesting actual user numbers may be closer to 87 million.

*Note: social media user data is much easier to find, as it typically comes from single sources that have a commercial incentive to report accurate user numbers for advertising purposes. For this reason, the reported number of active social media accounts in developing countries can be far larger than the number of reported internet users, as is the case for a number of countries in this year’s report.

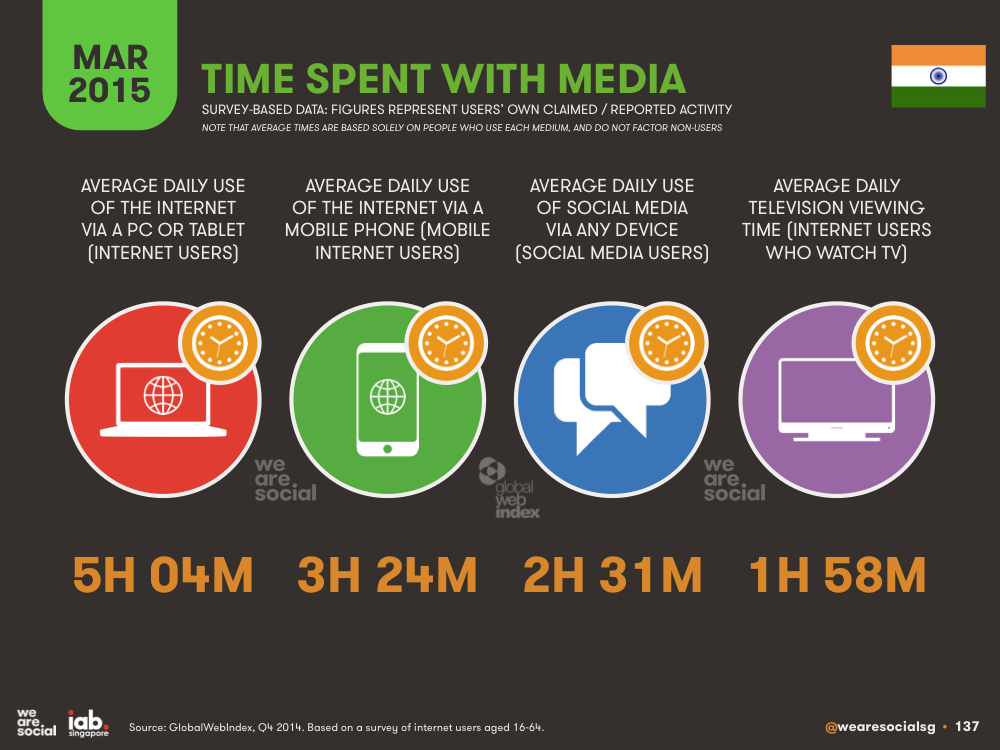

Internet users in Southeast Asia are amongst the most active in the world, with GlobalWebIndex reporting that average users in The Philippines, Thailand, Vietnam, Indonesia and Malaysia all spend more than 5 hours each day using the net.

Conversely – and perhaps somewhat surprisingly – internet users in Japan, South Korea and Hong Kong are all less active than the average user in GlobalWebIndex’s global survey, spending less than 3.5 hours per day on the net each day (compared to the average of 4.4 hours):

On the whole, the demographic profile of APAC’s internet users skews younger, with comScore finding that 61% of all users below the age of 35. The company also find that men are more active on the internet than women, accounting for more than 55% of all users:

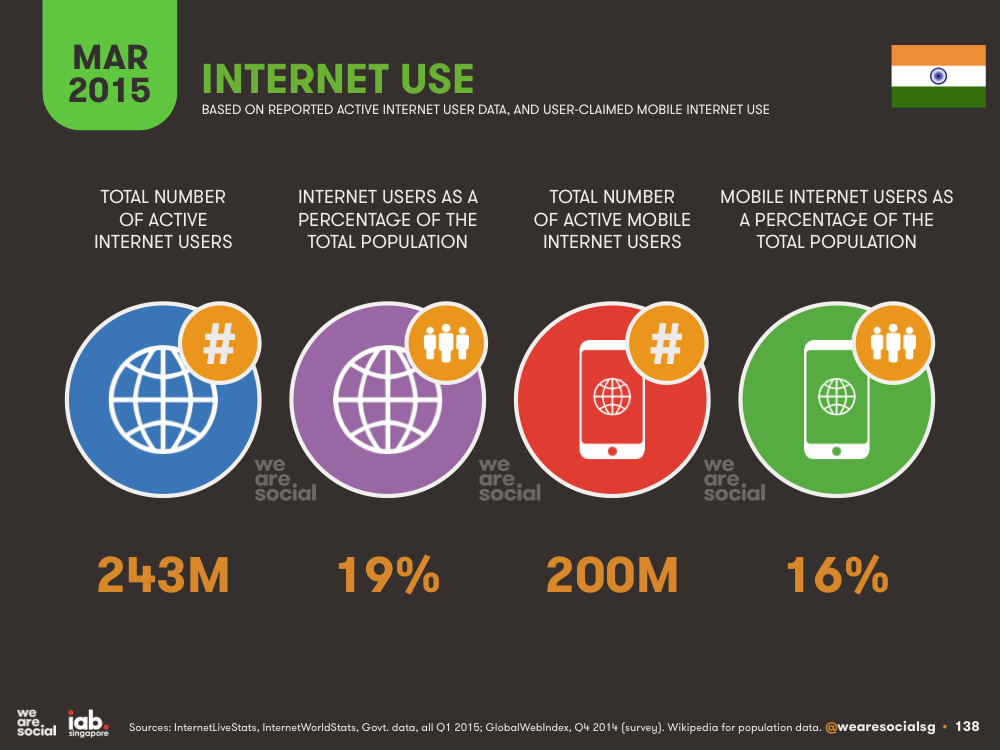

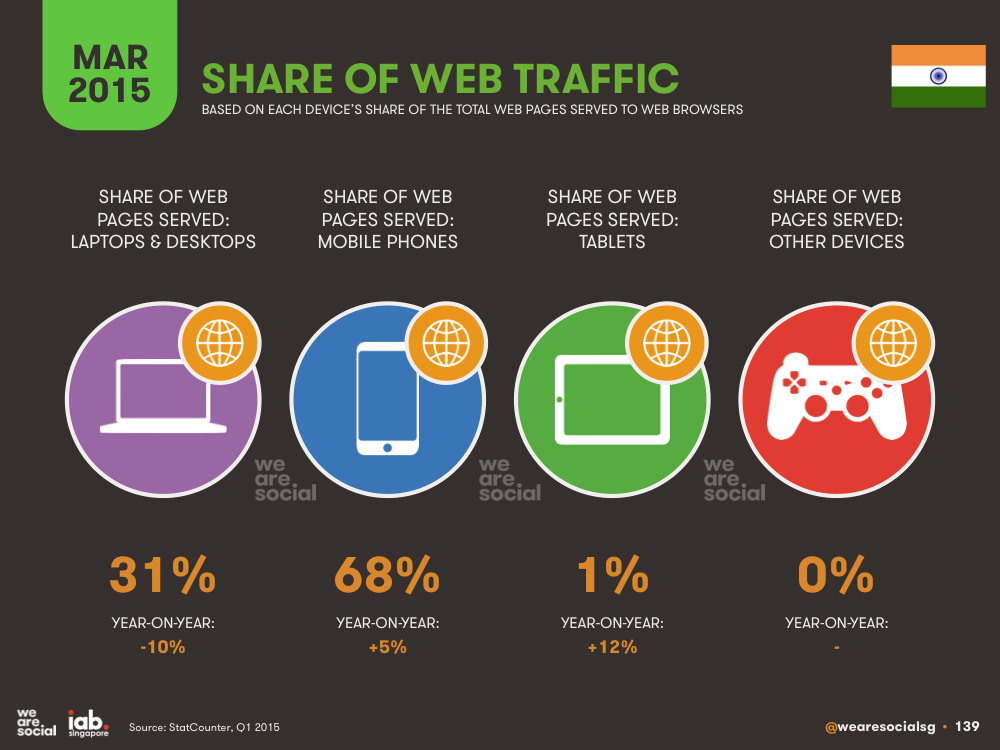

When it comes to access devices, internet use in APAC is an increasingly mobile affair, with a significant number of the region’s users now mobile-only.

When it comes to the overall volume of internet traffic, however, personal computers still dominate, accounting for around 53% of all web pages served in the region:

Desktop and laptops’ share of web traffic is down 9% year-on-year though, and current trends suggest that mobile’s share of web traffic in APAC will likely pass that of personal computers before the end of 2015.

There’s good news for brands when it comes to internet use in APAC too, with comScore reporting that corporate websites now reach more than 98% of the region’s web users:

E-commerce is on the rise too, with GlobalWebIndex data suggesting that more than half of the national populations of South Korea, Taiwan and Australia bought something online in the past month:

Alibaba leads the pack when it comes to e-commerce in APAC, with comScore data suggesting that the company reaches nearly half of the region’s web users. It’s nearest competitor, 360Buy, reaches more than one-quarter of the region’s web users, while Amazon comes in at third place with a reach of roughly 15%:

However, now that Amazon has its own store on Alibaba in China, the next few months could bring some interesting developments in APAC's e-commerce scene.

Social media In APAC

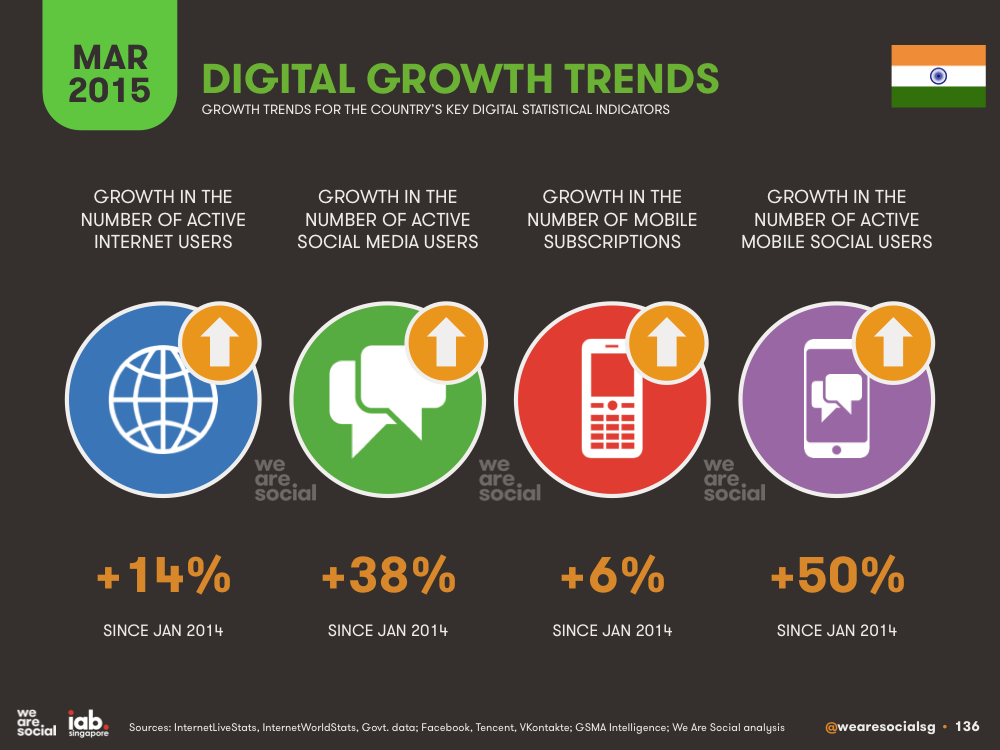

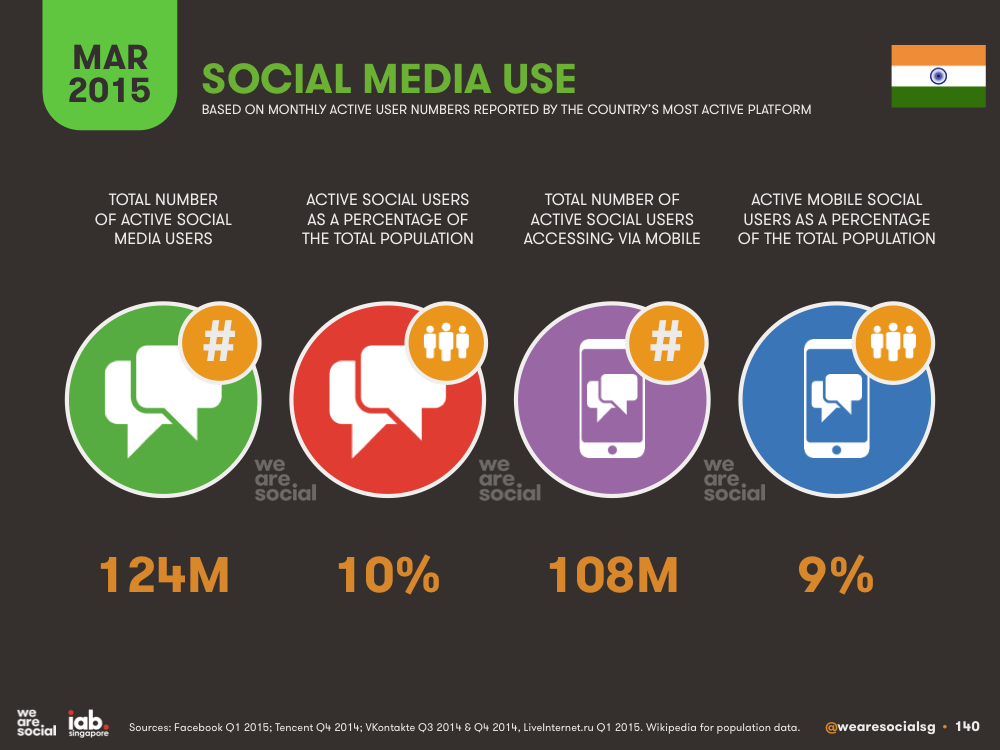

Social media users in APAC grew by more than 47 million since January, with some huge gains in individual countries.

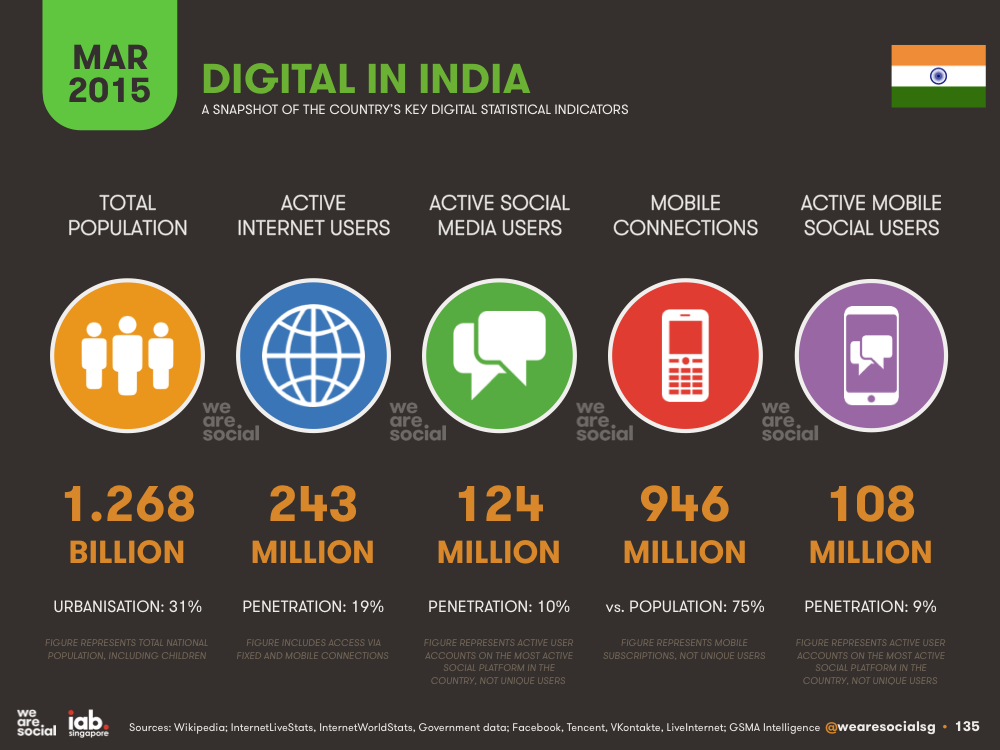

India recorded the largest absolute growth, up 6 million active Facebook accounts (+5%) to 124 million at the time of writing.

Thailand also saw impressive growth: 2 million new accounts in the past 2 months mean the country’s Facebook population grew by almost 7% since January.

The Philippines and Indonesia also added 2 million active Facebook accounts each since January, with the platform’s total audiences in those countries up 5% and 3% respectively.

Well over one-quarter of the region’s population now uses social media each month, although this usage is very unevenly distributed.

APAC is home to the world’s most socially active country – data from Facebook suggests that more than 90% of Singapore’s population used the platform in the past 30 days – but 21 countries around the region still have social media penetration levels below 10%, including 3 of the region’s most populous nations: India, Bangladesh, and Myanmar:

However, there’s plenty to be excited about, with active social media use growing by more than 12% in the past 14 months. This growth takes the region’s active user total well past the 1 billion mark, with regional penetration of 27%:

There’s still plenty of room for growth, too, and analysis of the current social media user base shows that many important demographic groups are still under-represented.

In particular, we hope to see significant growth in the number of women using social media around the region this year; Facebook’s APAC audience is more than 60% male, with women accounting for barely one-third of users aged 25-29:

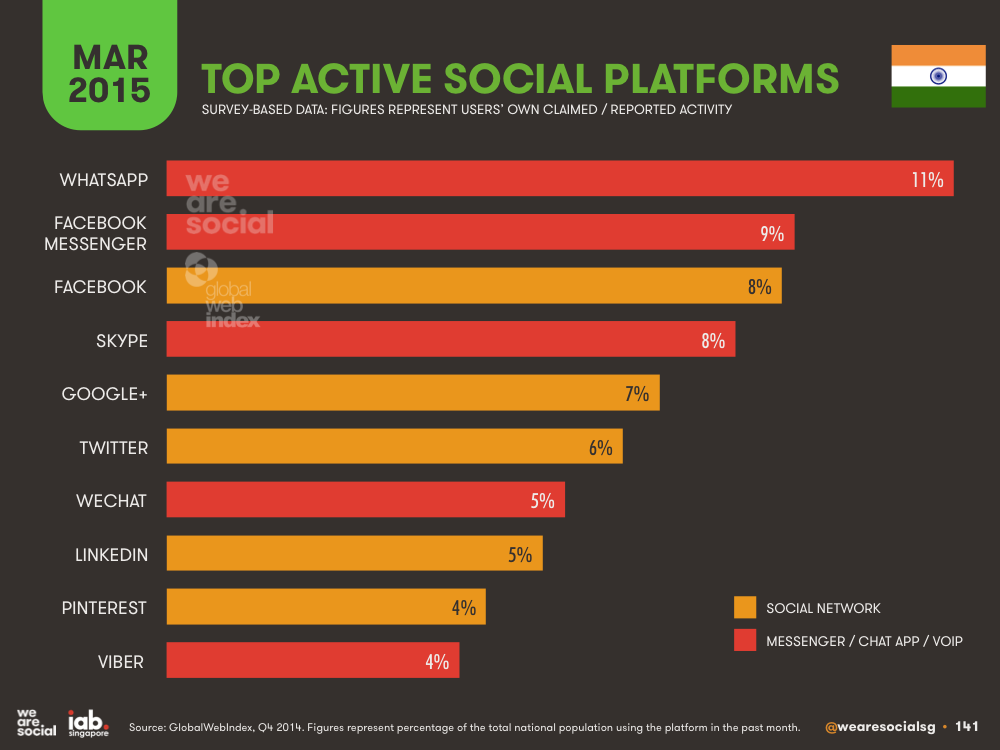

Although this uneven gender balance echoes the demographics of general internet usage, we suspect that some of this imbalance on Facebook may also be because women in APAC have been quicker to adopt more ‘real-time’ social platforms such as WhatsApp, WeChat, Instagram, and Snapchat, resulting in lower usage of Facebook amongst women aged 15 to 29 compared to their male counterparts.

We were also interested to note that Facebook use on tablet devices is evenly split between men and women though – an insight that may have value to marketers targeting women across Facebook and other online platforms in APAC:

The time spent on social media also varies significantly around the region, with marked differences between East and Southeast Asia. GlobalWebIndex finds that Filipinos are the greatest consumers of social media, spending more than 3.4 hours on social media activities each day.

Malaysians, Thais, and Indonesians all spend more than two hours per day on social media too, but it’s a very different story in Japan, where users claim to spend less than 20 minutes per day on social media activities:

Mobile social media In APAC

Mobile social media use surged almost 32% since last year’s report, increasing by 219 million active accounts to pass 900 million active users by March 2015:

As with other areas of this year’s report though, the penetration of mobile social media isn’t even across the region. Singapore leads the way at 87% - almost 4 times the regional average – but North Korea and Papua New Guinea both register less than 5%.

Pakistan, India, Bangladesh and Myanmar lag too, with data showing that mobile social penetration is still below 10% in these key countries:

However, growth in low-penetration countries has been particularly impressive over the past year, with Myanmar (+204%), Bangladesh (+132%), and Pakistan (+113%) all showing triple-digit growth.

India also showed strong growth (+50%), but there’s still a long way to go before mobile social becomes a part of everyday life in the world’s second-most-populous nation:

Mobile use in APAC

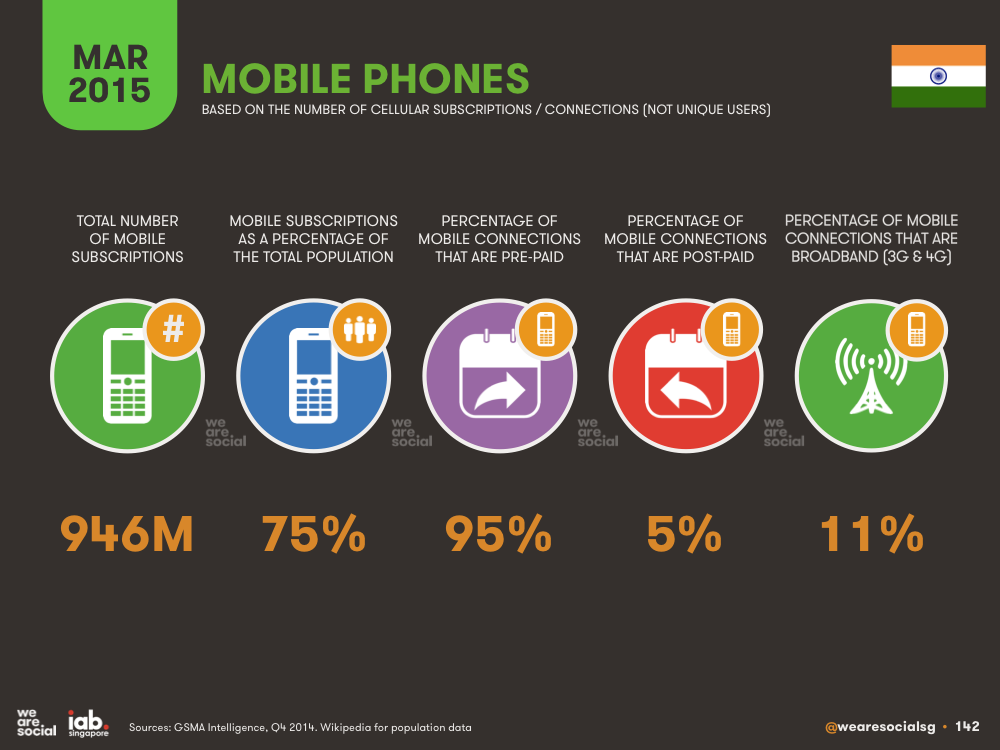

The number of mobile connections in APAC is rapidly approaching the same number as the region’s population, although as we reveal in the global section at the start of this year’s report, the average mobile phone user still maintains slightly fewer than 2 active mobile contracts; note that the following chart shows global data:

Our analysis of individual country data suggests that around 46% of APAC’s population currently uses a mobile phone, and current growth trends suggest that mobile phone penetration in APAC will pass 50% in just a few months, most likely around the end of Q3 2015.

Much of this growth is being driven by surging uptake in the region’s developing nations, with some of the region’s poorest nations showing the strongest growth in mobile phone usage over the past year.

However, some of the region’s more developed countries – notably Hong Kong – saw a decline in the total number of mobile connections in the past 14 months.

One reason for this may be that mobile internet connectivity allows people to connect with contacts on other mobile networks without incurring cross-network charges for services like SMS, so people are opting not to maintain multiple contracts as they upgrade to connected smartphones.

This reduction in the number of mobile contracts does not represent a drop in mobile usage, however, and all the evidence indicates that people in APAC are using their phones more and more each day.

This is great news for the region’s marketers, as mobile offers increasingly powerful, always-on connections to some of the world’s most inaccessible audiences.

However, there are a number of important features of the mobile landscape in APAC that marketers must contend with when planning their activities.

Firstly, APAC’s mobile landscape is still dominated by feature phones. The latest data from Ericsson suggest that roughly 60% of the region’s mobile connections are powered by feature-phone handset, which are characterised by smaller screens, lower-resolution graphics, and limited web-browsing capabilities (if they even exist at all) compared to smartphones.

This is a story repeated all across the world too; globally, around 58% of all mobile connections are associated with feature-phone handsets (note that the chart below shows worldwide usage data):

Secondly, more than three-quarters of APAC’s mobile connections are pre-paid, meaning that the cost of connectivity is still an important issue for many of the region’s mobile users.

Indeed, findings in a recent report from Facebook’s Internet.org initiative suggest that more than half a billion people around Asia-Pacific will struggle to afford sufficient data for even one hour of web browsing each month.

As a result, marketers shouldn’t confuse internet access with the desire or willingness to connect with brands online, and marketers hoping to connect with lower-income audiences would do well to explore ways to partner with organisations and companies who have launched initiatives to make universal internet access a reality, such as these projects from Google and Facebook.

Lastly, even for those with a smartphone and sufficient financial means to afford always-on mobile data, Akamai reports that the speed of mobile connectivity in many parts of APAC will leave many disappointed.

Mobile video viewing may well be one of the fastest growing activities on the web, but with more than 1 billion mobile users suffering connection speeds below 2Mbps, loading such content will be a frustrating experience.

Few audiences will have the patience to load commercial content lasting more than a few seconds unless they already know it’s going to be worthwhile, so if brands want to use mobile video to target audiences in developing parts of Asia, it’s imperative that they make truly remarkable, share-worthy content.

The good news is that mobile broadband access is increasingly rapidly around APAC though, and roughly one-third of the region’s population now uses a 3G or 4G connection:

Alongside enabling richer content experiences, such access should also help to boost mobile commerce, which is already showing signs of taking hold around the region.

South Koreans lead the way when it comes to making purchases on their mobiles, with GlobalWebIndex suggesting that more than one-third of the nation’s population bought something via a mobile phone last month. M-commerce is catching on in Taiwan and China too, with data suggesting that more than a quarter of each country’s respective population bought something with their phones in the past 30 days:

What's next?

Despite all these impressive numbers, digital, social and mobile still have plenty of room for growth in APAC, and we’re predicting an acceleration in growth throughout 2015 as mobile connectivity brings internet access to hundreds of millions more people around the region.

We expect the reported number of internet users to increase sharply by the end of the year, largely due to more accurate and timely measurement of mobile internet access.

However, current growth rates suggest that internet penetration in APAC won’t reach 50% until sometime in 2017, meaning that more than half the region’s population will be missing out on what the United Nations has classified as a ‘basic human right’ for at least another few years.

Countering this though, the number of mobile users is likely to pass 50% of the region’s population sometime in Q3 this year, offering real potential for more rapid adoption of the internet, especially in developing nations where limited infrastructure has hindered access.

Because of this, the vast majority of APAC’s ‘new wave’ of internet users will be mobile-first, and our prediction is that at least half of the next 500 million internet users will be mobile-only.

That means that marketers will need to rethink much of their current approach to communications, especially in digital media. Mobile internet usage occurs more frequently, but in smaller ‘servings’ than fixed internet access, and marketers will need to adapt brand communications for this little-and-often behaviour.

Critically, audiences are fully in control of their mobile content experiences, so advertising’s key task must evolve from trying to find audiences – mobile data should make targeting very straightforward – to trying to find ways to keep audiences interested and engaged.

Our focus must evolve from a broadcast paradigm in which media planning was largely driven by a quest advertising efficiency, to a context planning approach that is more focused on driving greater marketing effectiveness.

That shouldn't come as a revelation, but marketing in APAC still has some way to go before this common sense becomes an everyday part of our approach.

Over to you

If you’d like to explore the individual country data in more detail, you might like to know you can download the complete report(s) for free. Click here to download a free PDF of Part 1 of this report, and click here to download a free PDF of Part 2 (you may need to sign in to SlideShare first).

You may also want to refer back to our reports from previous years; you’ll find them all in one convenient library here, but you may find our 2014 APAC report and analysis particularly useful.

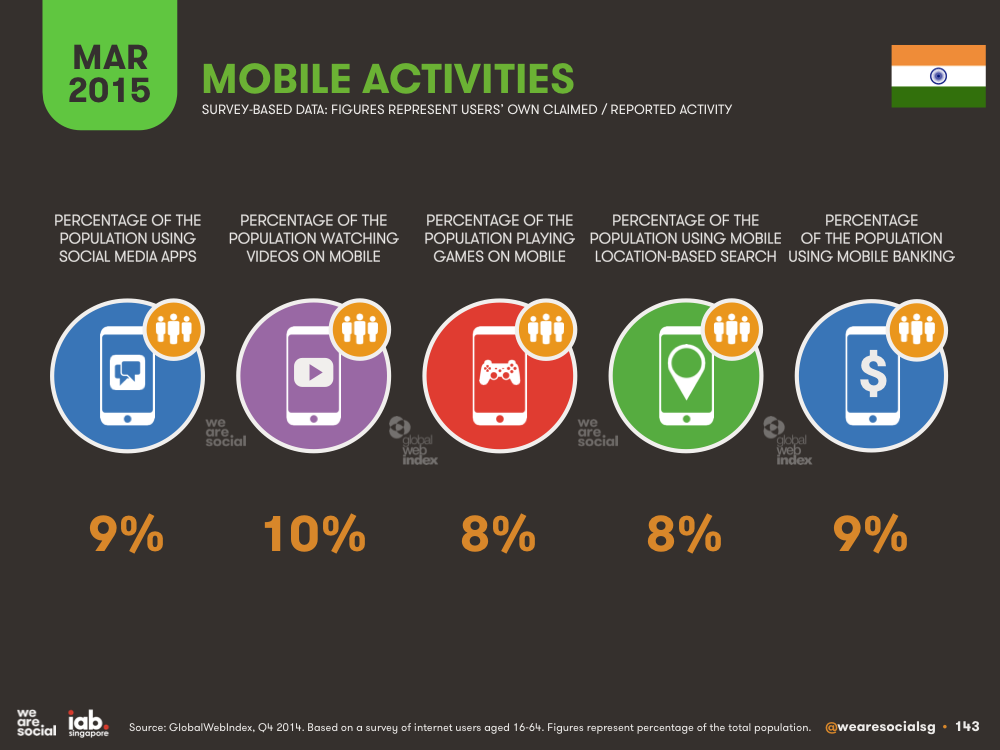

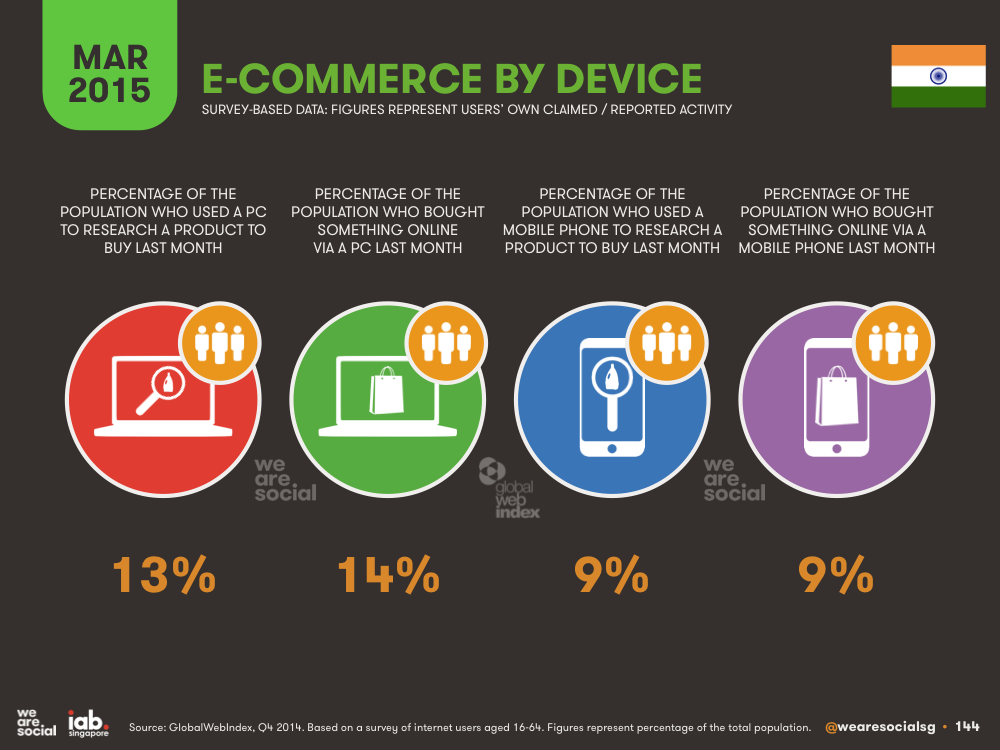

But with that, we’ll leave you with our India data; just one of the 30 individual country deep-dives you’ll find in the full report:

This article first appeared on the We Are Social blog.