Digital 2023 Deep-Dive: Trends in online finance

Across most of the trends in our Digital 2023 reports, we tend to see higher adoption of digital innovations amongst younger internet users compared with older generations.

However, in this article, we’ll explore an intriguing exception to that rule.

Let’s dive in.

Old money

One of the findings that surprised me whilst analysing this year’s data is that older internet users are considerably more likely to use online financial services compared with younger generations.

Indeed, GWI’s latest wave of research shows that men aged 55 to 64 are almost twice as likely to use online financial services compared with women aged 16 to 24.

Fewer than 1 in 5 female Gen Z internet users (19.9 percent) say that they use online banking, investment, and insurance services each month, compared with more than 1 in 3 users (35 percent) in their father’s generation.

Overall, men are more likely to use online financial services compared with women, although it’s worth highlighting that the opposite is true when we look at the data for internet users aged 25 to 24.

Follow the money?

My first thought was to interpret this imbalance as suggesting that people who are more “financially empowered” (read: richer) are more likely to use online financial services.

However, when we look at the adoption of these services by country, that hypothesis doesn’t stand up.

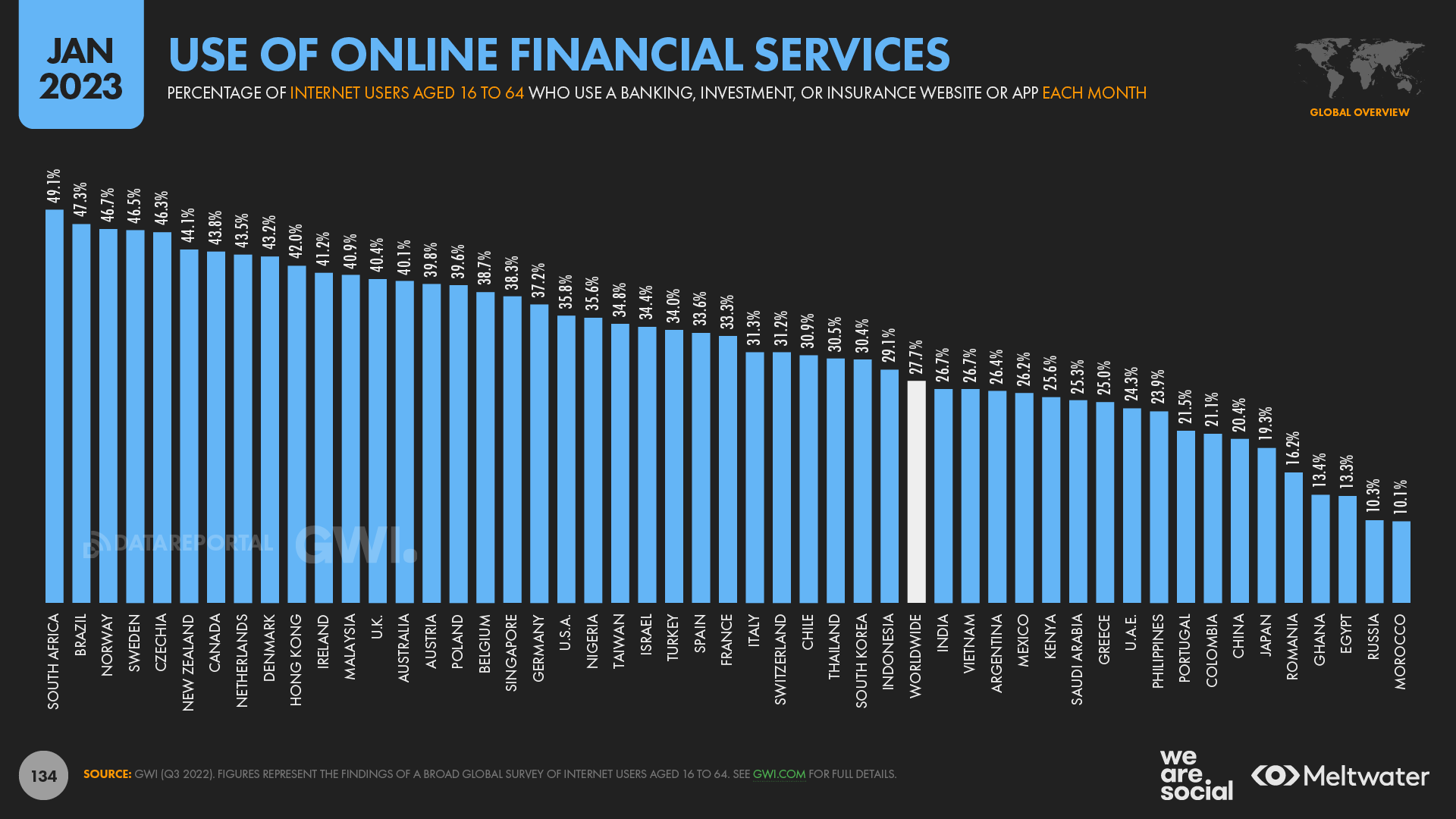

Indeed, GWI’s data shows that South Africa and Brazil come out at the top of the rankings, well ahead of more “developed” economies like the United States and the United Kingdom.

The data for Japan also confounds this hypothesis, with the G7 country appearing close to the bottom of the latest rankings.

This is particularly surprising given the trends by age that we explored above, because Japan has one of the oldest populations in the world.

Financial blocks

Meanwhile, data for cryptocurrency ownership around the world adds another layer of complexity to this story.

Overall, the data clearly show that “crypto bros” isn’t just a stereotype, with men still 66 percent more likely than women to own digital coins like Bitcoin and Ether.

And once again, people in less developed economies are more likely to hold these newer digital assets, with Turkey, Argentina, and the Philippines topping the ranking for cryptocurrency ownership.

In some instances, the disproportionate popularity of crypto may be largely tied to the weakness of local fiat currencies, especially in countries like Turkey and Argentina.

However, in South-Eastern Asian countries like the Philippines and Thailand, crypto’s popularity may be more closely linked to its role in online gaming, especially the purchase of virtual goods, or the ability to earn tangible financial returns in virtual environments like Axie Infinity.

Takeaways

There are many different ways to read this data, and inevitably, issues such as financial empowerment, local legislation, and fears relating to the security of online assets and digital networks will play a role.

However, the latest data suggest that the financial services industry is struggling to meet the needs of younger users, especially in more developed markets.

As a result, despite the banking industry’s impressive investments in “digital transformation”, it seems that there’s still plenty of potential for digital disruption in the world of online banking and finance.

If you want to follow developments in this story, be sure to check back for our regular Statshot reports throughout 2023 and beyond.

Disclosure: Simon Kemp is a brand ambassador for GWI.

Click here to see all of Simon’s articles, read his bio, and connect with him on social media.